How to Evaluate an Offer on Your Home

Quick Overview: How to Evaluate an Offer on Your Home

Selling your home isn’t just about the highest price — the best offer is the one most likely to close smoothly. Here’s what to look at beyond the numbers:

Price vs. Profit: Focus on net proceeds, not just the top-line number.

Buyer’s Financing: Favor cash or solid pre-approval letters.

Contingencies: Fewer contingencies mean less risk of delays or cancellations.

Timeline: Closing speed should match your moving plans.

Earnest Money & Concessions: Deposits show commitment, while requests for repairs or cost-sharing reduce your profit.

Choosing the right offer means balancing price with terms, timing, and reliability so you can move forward with confidence.

Selling your home is exciting, but the real challenge starts when offers begin to arrive. Many homeowners think the highest price is automatically the best choice, but in reality, the strongest offer is the one most likely to close smoothly. Every proposal has fine print, and overlooking details can cost you money, time, and peace of mind. Learning how to evaluate an offer step by step will help you choose the buyer who is financially secure, realistic, and ready to follow through.

1. Look Beyond the Price Tag

The sale price grabs attention first, but it shouldn’t be the only number that matters. A buyer might submit a higher offer that looks impressive but could fall apart during financing or appraisal. For example, if someone offers $460,000 on a home listed at $450,000, but the appraisal only comes back at $445,000, you may end up renegotiating or losing the deal altogether.

A better approach is to compare what each offer means for your actual profit. Timing also plays a role — knowing the best time to sell your house can help you attract stronger offers from the start. Ask yourself: Does the buyer want you to pay closing costs? Are they asking for costly repairs or upgrades before closing? A slightly lower purchase price without extra conditions may leave you with more money in your pocket.

Quick tips:

- Review net proceeds, not just the sale price.

- Watch for inflated offers that depend on appraisal results.

- Balance price with the strength of the overall package.

2. Review the Buyer’s Financial Security

The best offer is one that can be funded without delays. Cash buyers typically bring the strongest offers because they skip the lender process entirely. Cash offers reduce the risk of financing falling through and often lead to faster closings.

When buyers need a mortgage, look for a solid pre-approval letter from a reputable lender. If you’re new to the process, First Star Realty’s step-by-step guide to the home loan process breaks down what to expect. For an even broader perspective, the Consumer Financial Protection Bureau offers a clear overview of loan options and what pre-approval really means. Pre-qualification is not enough — it’s only an estimate. Pre-approval shows the lender has verified income, credit, and employment. If a buyer hasn’t reached this step, their financing may be uncertain.

Another important factor is the type of loan. FHA and VA loans help many buyers purchase homes but often come with stricter property requirements. Conventional loans usually involve fewer hurdles.

Quick tips:

- Favor cash offers when possible.

- Ask to see pre-approval, not just pre-qualification.

- Consider the loan type and how it might affect the process.

3. Evaluate Contingencies Carefully

Contingencies are conditions that protect buyers, but they also create risks for sellers. The National Association of Realtors explains how common contingencies like inspection, appraisal, and financing work in real estate contracts. The most common include:

- Inspection contingency: lets the buyer request repairs or back out after inspection.

- Appraisal contingency: allows the buyer to cancel if the home appraises below the offer price.

- Financing contingency: gives the buyer time to secure a loan, with the right to exit if denied.

- Home sale contingency: means the buyer must sell their current home first.

Too many contingencies weaken an offer, and it’s important to understand how they affect your sale. Here’s a guide on making a winning offer in real estate that explains how contingencies can strengthen or weaken a deal. For example, a buyer offering $455,000 with four contingencies may be riskier than one offering $445,000 with only an inspection contingency. While it’s normal to accept some conditions, fewer contingencies usually mean a higher chance of closing.

Quick tips:

- Identify which contingencies are deal breakers.

- Fewer contingencies = stronger offers.

- Home sale contingencies carry the most risk.

4. Pay Attention to Speed of Sale

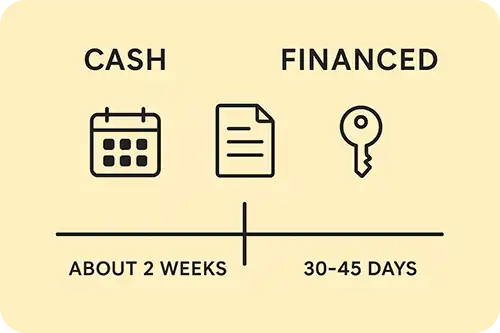

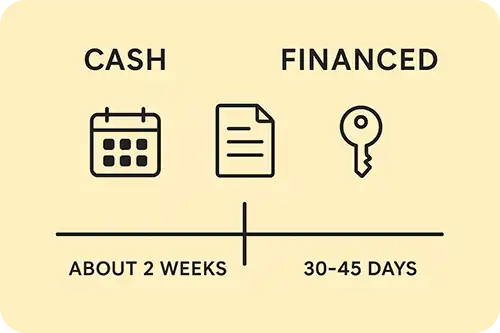

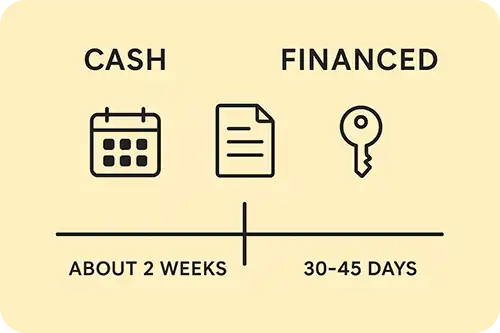

Timing can matter as much as money. If you’re relocating for work or have already purchased another property, a buyer who can close quickly may save you months of carrying costs. On the other hand, if you need time to find your next home, a buyer willing to delay closing can reduce stress.

A standard closing timeline is 30–45 days. Cash buyers may close in as little as two weeks, while buyers with complicated loans may need longer. For a full breakdown of the buying and selling process, see HUD’s official guide to home buying. Matching the buyer’s schedule with your own moving plans is an often-overlooked step that can prevent last-minute headaches.

Quick tips:

- Compare each buyer’s closing timeline with your plans.

- Faster closings reduce carrying costs.

- Flexibility can be valuable if you need extra time.

5. Consider the Earnest Money Deposit

Earnest money is the buyer’s way of proving they are serious. Typically ranging from 1–3% of the purchase price, this deposit is placed in escrow and applied to the final purchase. Strong earnest money shows commitment and reduces the chance of a buyer walking away for no reason.

If the buyer backs out for a reason not covered by a contingency, you usually keep the earnest money. However, if they cancel under a valid contingency, they receive it back. This is why higher earnest money combined with fewer contingencies makes an offer stronger.

Quick tips:

- Look for earnest money deposits of at least 1–3%.

- Higher deposits signal stronger commitment.

- Always confirm how the deposit is protected in escrow.

6. Watch for Seller Concessions and Extras

Concessions can change how much money you actually make from the sale. A buyer may ask you to cover part of their closing costs, pay for a home warranty, or handle expensive repairs before closing. These requests reduce your net profit and sometimes extend the timeline.

For example, if one buyer offers $450,000 but asks for $8,000 in closing cost help, and another offers $445,000 with no concessions, the second offer leaves you ahead financially. Always calculate the net result, not just the top-line number. Many homeowners also overlook the hidden costs of buying a home, which buyers may try to offset by requesting concessions.

Quick tips:

- Subtract concessions from the purchase price to see true profit.

- Repairs, upgrades, or cost-sharing can add up quickly.

- A lower price without concessions may be better than a higher price with them.

7. Don’t Overlook Emotional Considerations

While real estate is mostly a financial transaction, emotions can still play a role. Some sellers care about who buys their home — for example, preferring a family who will enjoy the house or buyers who respect their desired move-out date.

These factors won’t always outweigh money, but they can make a difference when offers are close. If two offers are nearly identical, emotional fit may guide your choice. For many sellers, peace of mind and a smooth handoff matter just as much as the final price.

Quick tips:

- Decide if non-financial factors matter to you.

- Consider flexibility, communication, and personal fit.

- Use emotional factors only as a tie-breaker.

8. Compare Multiple Offers Side by Side

Evaluating offers is easier when you see them next to each other. Create a chart listing price, financing type, contingencies, earnest money, closing date, and concessions. This makes strengths and weaknesses clear at a glance.

For example, Offer A might have the highest price but weaker financing and a long closing period. Offer B may be slightly lower in price but all cash with few contingencies. With a side-by-side comparison, you’ll see which offer is more reliable and profitable.

Quick tips:

- Use a simple chart to compare terms.

- Focus on net profit, not just price.

- Identify which terms carry the least risk.

9. Work with a Seasoned Real Estate Professional

An experienced real estate agent is your best resource during this process. They know how to analyze offers, spot red flags, and negotiate better terms. While sellers may focus on the purchase price, agents see the whole picture and understand how each detail impacts the final outcome.

Working with a professional also saves time and stress. Instead of decoding legal language on your own, you’ll have someone guiding you through each step, ensuring you accept the offer most likely to close without problems.

Quick tips:

- Lean on your agent’s experience and knowledge.

- Ask questions about risks you may not see.

- Use professional guidance to negotiate stronger terms.

Conclusion

The strongest offer on your home isn’t always the one with the biggest price tag — it’s the one that gives you confidence the deal will close smoothly. By weighing financing, contingencies, earnest money, concessions, and timelines, you can protect your interests and move forward with peace of mind.

When you’re ready to sell your home and take the next step, turn to First Star Realty. Our team brings years of experience helping sellers in Northwest Arkansas make smart, profitable decisions with less stress. We put clients first, keep communication clear at every step, and measure success only through your satisfaction. If you’re ready to buy or sell, call First Star Realty at 479-267-1600 or fill out our contact form today to get started with a trusted partner by your side.