Airbnb vs. Long-Term Lease vs. Corporate Rental: Which Rental Strategy Is Best for Your Property?

Airbnb vs. long-term lease vs. corporate rental; choosing between these rental models can feel overwhelming, especially when each offers different benefits, income potential, and time commitments. Whether you’re a homeowner exploring renting for the first time or an investor evaluating your next move, understanding how each option works is key to making the smartest decision for your property. Here, we’ll break down the pros, cons, and ideal use cases of each rental strategy, helping you confidently identify the best fit for your goals.

Quick Overview: Airbnb vs. Long-Term Lease vs. Corporate Rentals

Airbnb (short-term rentals) offers the highest earning potential and maximum flexibility, but requires significant management and comes with regulatory and income volatility risks.

Long-term leases provide stable, predictable monthly income with minimal hands-on work, though they offer the lowest earning upside and less flexibility for owners.

Corporate rentals serve traveling professionals and deliver mid-term stays with higher income than long-term leases and less turnover than Airbnb, but require furnishing and rely on specific market demand.

The best rental strategy depends on your goals, time availability, and local market: Airbnb suits high-tourism areas, long-term leases fit residential family homes, and corporate rentals thrive near hospitals, business hubs, and universities.

Understanding the Three Rental Models

While Airbnb, long-term leases, and corporate rentals all involve renting out a property, they differ significantly in lease length, tenant type, management intensity, and income structure. Below is a quick overview to understand each type of investment property prior to exploring its pros and cons.

Airbnb (Short-Term Rentals)

Airbnb rentals are considered short-term rentals, typically ranging from one night to a few weeks. Properties are listed on platforms like Airbnb or Vrbo and rented to travelers, vacationers, or short-term guests. Some key features include:

✓ Rental length: Nightly to a few weeks

✓ Tenant type: Vacationers, travelers, short-term guests

✓ Pricing: Nightly rates that fluctuate based on demand and season

✓ Furnishing: Fully furnished, utilities and Wi-Fi included

✓ Property management level: High (frequent cleaning, guest communication, turnovers)

✓ Income profile: Higher earning potential, but less predictable

Long-Term Lease (Traditional Rentals)

Long-term leasing is the most traditional and widely used rental model. Properties are rented to tenants under a fixed lease, usually lasting 6 to 12 months or longer. Some traditional rental property features include:

✓ Rental length: 6–12 months or longer

✓ Tenant type: Individuals or families seeking stable housing

✓ Pricing: Fixed monthly rent

✓ Furnishing: Typically unfurnished; tenants pay utilities

✓ Rental management level: Low to moderate

✓ Income profile: Stable, predictable cash flow

Corporate Rentals (Medium-Term / Executive Housing)

Corporate rentals fall between Airbnb and long-term leasing in terms of lease length and management intensity. These rentals typically serve traveling professionals, such as consultants, healthcare workers, executives, or individuals relocating for work or insurance-related housing.

✓ Rental length: 30 days to 6+ months

✓ Tenant type: Traveling professionals, relocations, insurance placements

✓ Pricing: Monthly rates are higher than long-term leases

✓ Furnishing: Fully furnished with utilities included

✓ Management level: Moderate

✓ Income profile: More stable than Airbnb guests with higher upside than long-term leases

Airbnb: Pros, Cons, and Best Use Cases

Airbnb properties are growing in popularity, as they offer property owners a lot of flexibility compared to traditional renting. Below are some of the advantages and disadvantages of using your home as an Airbnb rental property.

How Airbnb Rentals Work

Airbnb rentals operate on a short-term basis, typically rented by the night or week through platforms like Airbnb and Vrbo. Guests book the space for travel, vacations, business trips, or weekend stays. Property owners (or hired managers) handle guest communication, cleaning between stays, and listing management, including pricing, availability, and responding to reviews. Most Airbnb properties must be fully furnished and include utilities, Wi-Fi, and household essentials.

Pros of Airbnb Rentals

✓ Higher rental income potential: Nightly pricing allows owners to charge premium rates during peak seasons, holidays, and local events.

✓ Flexibility for personal use: Owners can block off dates to stay in the property themselves or host friends and family.

✓ Dynamic pricing: Hosts can adjust rates based on demand, competition, and seasonality to maximize earnings.

✓ Tax advantages: Furnishing and operating costs may be deductible (consult a tax professional to confirm eligibility).

Cons of Airbnb Rentals

Unpredictable income: Bookings fluctuate with season, travel trends, and the economy, leading to inconsistent monthly revenue.

Labor-intensive management: Frequent turnover means more cleaning, restocking, maintenance, and guest communication.

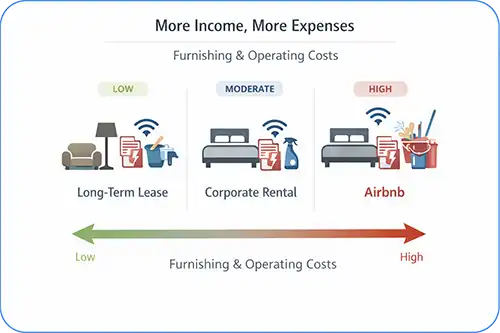

Higher expenses: Furnishing, utilities, supplies, cleaning fees, and platform fees reduce net profit.

Regulatory risk: Some cities restrict or ban short-term rentals, require licensing, or impose occupancy taxes. Certain localities also have rental laws that prohibit putting property on Airbnb.

Best Properties for Airbnb

✗ The following specifications can help you get the most out of what Airbnb offers for real estate investors or those looking to become Airbnb hosts:

✗ Homes or condos in tourist destinations, near beaches, ski areas, amusement parks, or national parks

✗ Properties near event venues, convention centers, downtown nightlife, or stadiums

✗ Smaller properties like studios and one-bedroom units that appeal to solo travelers or couples

✗ Homes with unique amenities like pools, hot tubs, views, outdoor living space, or stylish interiors

Long-Term Leasing: Pros, Cons, and Best Use Cases

Long-term rentals provide more consistent levels of income, as long-term tenants guarantee a stable monthly income. Still, if you want to rent out your property, it’s good to consider the following.

How Long-Term Rentals Work

A long-term rental is leased to a tenant for 6–12 months or longer, secured through a legal lease agreement. Tenants typically pay rent monthly and may cover additional costs such as utilities, lawn care, or trash service. Landlords handle move-in preparation, tenant screening, maintenance requests, and lease renewals, but overall, day-to-day involvement is minimal once the tenant has moved in.

Pros of Long-Term Leases

✓ Stable and predictable income: Monthly payments from a long-term rental agreement help with budgeting and financial planning.

✓ Lower management demand: Once a tenant is placed, turnover is low, and communication is occasional.

✓ Lower operating costs: Properties are often unfurnished, and utilities are commonly tenant-paid.

✓ Easier financing and insurance: Banks and insurers often prefer properties with long-term tenants, especially for investment loans.

Cons of Long-Term Leases

✗ Lower revenue ceiling: Monthly rent is fixed, so income won’t spike during high-demand seasons or events.

✗ Less flexibility: Owners can’t easily reclaim the space for personal use while tenants remain in a fixed lease.

✗ Tenant-related risks: Late payments, property damage, or evictions can still occur with poorly screened tenants.

✗ Slower adjustment to rental market rates: If rent increases sharply, you may be locked into outdated pricing until lease renewal.

Best Properties for Long-Term Leasing

Some of the best properties to offer for long-term leasing to help reduce tenant turnover and create stable income include:

✓ Single-family homes in suburban neighborhoods

✓ Properties near schools, grocery stores, parks, and major employers

✓ Homes designed for families or long-term residents (2–4 bedrooms, garages, yards)

✓ Markets where short-term rentals are restricted or illegal

Corporate Rentals: Pros, Cons, and Best Use Cases

Corporate rentals fall somewhere in between long-term renting and short-term vacation rentals. They’re specifically tailored to the needs of business travelers. They’re still catered to short-term stays (when compared to traditional long-term leases), but often have amenities included that are beneficial for professionals.

How Corporate Rentals Work

Corporate rentals are typically leased for 30 days to 6+ months, and are marketed through furnished rental platforms, corporate housing agencies, or direct partnerships with businesses. These properties must usually be fully furnished, move-in ready, and include utilities, Wi-Fi, and often cleaning services. Owners may work with a corporate housing provider who handles bookings and tenant placement, or manage the rental independently.

Pros of Corporate Rentals

✓ Higher monthly income than long-term leases while still maintaining mid-term stability

✓ Lower turnover than short-term rentals, meaning fewer cleanings and less constant communication

✓ Reliable occupants: Corporate tenants are often backed by employers, travel agencies, or insurance companies

✓ Appealing mix of flexibility and revenue: Owners can reclaim or re-rent the home sooner than a year-long lease

Cons of Corporate Rentals

✗ Upfront costs: Factors like furnishing the home and stocking essentials can be expensive

✗ Narrower renter pool: Demand varies by city and depends heavily on the presence of corporate offices, hospitals, military bases, or universities

✗ Potential for longer vacancy periods if demand is low or marketing is limited

✗ More amenities expected: Smart TVs, desks, kitchenware, parking, laundry, and fast Wi-Fi are standard expectations

Best Properties for Corporate Rentals

✓ Some of the best options for corporate housing include:

✓ Apartments or condos near business districts, hospitals, technology centers, or financial hubs

✓ Homes within commuting distance of universities, medical centers, or military bases

✓ Properties with dedicated parking, strong Wi-Fi, workspace areas, and turnkey furnishings

✓ Quiet, professional spaces that appeal to extended-stay guests versus vacation travelers

Airbnb vs Long-Term Lease vs Corporate Rental: Side-by-Side Comparison

| Factor | Airbnb (Short-Term Rental) | Long-Term Lease (Traditional Rental) | Corporate Rental (Medium-Term) |

|---|---|---|---|

| Typical Length of Stay | 1–30 nights | 6–12+ months | 30 days – 6+ months |

| Income Potential | Highest (varies by season & demand) | Lowest but steady | Moderate-High |

| Income Stability | Unpredictable month-to-month | Very stable and reliable | Stable, though vacancy periods may occur |

| Management Effort | High: frequent turnover, cleaning, and guest communication | Low: minimal involvement after placing a tenant | Moderate: lower turnover than Airbnb, but still requires oversight |

| Furnishing Requirements | Fully furnished, fully stocked | Usually unfurnished | Fully furnished with amenities |

| Vacancy Risk | High: depends on tourism and travel demand | Low | Moderate: depends on local industries (hospitals, corporate hubs) |

| Flexibility for Owner Use | Very high: owner can block off dates | Very low: lease terms restrict personal use | Moderate: gaps between tenants may allow personal use |

| Regulatory Risk | Highest: many cities restrict short-term rentals | Lowest: traditional leases widely accepted | Moderate: may require special agreements or insurance |

| Tax & Operating Costs | Highest: cleaning, supplies, utilities, platform fees | Lowest: utilities often tenant-paid | Moderate: utilities included, possibly cleaning |

| Ideal Property Types | Vacation homes, downtown condos, high-tourism areas | Suburban homes, residential neighborhoods | Homes near hospitals, business districts, universities, tech, or military bases |

| Best For | Owners seeking maximum revenue + flexibility & willing to manage or hire a manager | Owners who want passive income with minimal time involvement | Owners wanting a higher income than long-term leases without the workload of Airbnb |

How to Choose Between Short-Term and Long-Term Rental Properties

Deciding whether Airbnb, a long-term lease, or a corporate rental is right for your property ultimately comes down to your goals, lifestyle, and local market. Airbnb may offer the highest earning potential, but long-term leases provide unmatched stability, and corporate rentals deliver a balanced middle ground. The best option for property investment and rentals is the one that aligns with your time commitment, comfort with risk, and desired level of involvement.

If you’re unsure which approach makes the most sense, First Star Realty is here to help. Contact us today to learn more.