A Beginner’s Guide on How to Invest in Real Estate

How to invest in real estate is a common question for beginners who want to build wealth and create long-term income. Real estate can be a stable and rewarding way to grow your money, but getting started can feel confusing at first. The real estate industry offers many paths, and this guide will help you understand the basics before you begin. This beginner’s guide breaks down the basics into clear, simple steps. You’ll learn what real estate investing is, why it can be a smart choice, how much money you may need, and which strategies are easiest to start with.

What Is Real Estate Investing?

Real estate investing means buying property to earn money. Investors make money in two ways—through rental income and by selling property for a higher price than they paid. This type of investment can include houses, apartments, commercial real estate, land, or even shares in real estate funds.

There are many ways to invest in real estate. Some people buy homes to rent out. Others buy property to fix and resell. Some choose to invest without owning property by buying into Real Estate Investment Trusts (REITs).

Real estate is a physical asset. Unlike stocks or digital assets, you can see and use property. That makes it attractive to many first-time real estate investors who want something tangible with steady income potential.

Benefits of Real Estate Investment

Real estate offers several clear benefits for beginners. One of the biggest is passive income. If you rent out a property, the monthly rent can provide steady cash flow.

Another benefit is long-term value. Real estate tends to rise in value over time. This increase, known as property appreciation, helps investors build long-term equity. Even if prices dip short-term, property often gains value in the long run.

You may also get tax benefits. In many cases, you can deduct mortgage interest, repairs, and other costs. This helps reduce your overall tax bill.

Real estate also lets you use leverage. You can buy a property with a loan, which means you don’t need to pay the full price upfront. This allows you to start investing with less money.

Finally, real estate helps diversify your portfolio. It adds another source of income besides the stock market or savings, which lowers your overall risk and increases financial stability.

Common Real Estate Investment Strategies

There are several ways to invest in real estate, even if you’re a beginner.

One option is rental property investing. You buy a home or apartment and rent it to tenants, generating monthly income and long-term value. This can provide regular income and long-term growth.

Another strategy is flipping houses. You buy a property, renovate it, and sell it for more than you paid. This can bring fast returns but carries higher risk.

Some beginners prefer REITs (Real Estate Investment Trusts). These are companies that own or manage real estate. You can invest in them like stocks, without owning property yourself.

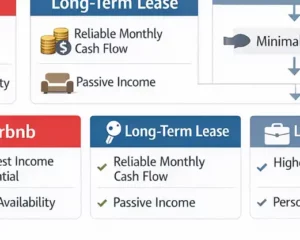

Short-term rentals are also popular. Platforms like Airbnb let you rent out homes for days or weeks at a time. This works well in tourist areas and can bring in more money than long-term leases. Learn more about investing in vacation rentals and how they can fit into your strategy.

A newer option is real estate crowdfunding. This allows you to invest small amounts in large projects online. You join other investors and share the profits.

Each strategy has pros and cons. The best choice depends on your budget, goals, and risk comfort.

How to Get Started: Step-by-Step

Starting in real estate is easier when you follow a clear plan.

1. Set your goals.

Decide why you want to invest in real estate. Do you want monthly income, long-term value growth, or both? Clear goals—and understanding the important factors in real estate investing—will guide your decisions.

2. Know your budget.

Look at how much money you can invest. Include savings, loans, and credit options. If you’re not financially ready yet, you can still take steps today. Start building smart money habits with these 12 good habits to help you buy a home. Also, consider your risk tolerance—how much uncertainty or loss you’re willing to accept in exchange for potential return.

3. Learn the market.

Study different areas before you buy. Look for places with job growth, rising property values, and high rental demand. Check out the best cities to invest in real estate right now to see where the strongest opportunities are.

4. Choose a strategy.

Pick the approach that fits your goals—rental property, flipping, REITs, or another method.

5. Build your team.

You may need a real estate agent, mortgage broker, and property inspector. Choose people who understand your goals.

6. Run the numbers.

Estimate your income and expenses. Include mortgage, taxes, repairs, and vacancies. Make sure the deal makes financial sense.

7. Make your first investment

Once everything checks out, move forward. Start small if needed, and build experience as you go.

Mistakes to Avoid as a Beginner

Many beginners lose money because they skip key steps. The most common mistake is failing to research. Before you buy, learn about the area, the property, and the local rental market.

Another mistake is underestimating costs. New investors often forget about repairs, property taxes, insurance, and vacancy periods. These costs add up and can hurt your profits.

Some investors ignore property management. If you don’t want to manage tenants yourself, consider hiring a property manager to handle rent collection, maintenance, and tenant issues.

Overleveraging is also risky. If you borrow too much and your income drops, you might struggle to make payments. It’s safer to start with a manageable loan and a solid emergency fund.

Finally, not having a backup plan is a big risk. Vacancies, market drops, or repair issues can happen. A smart investor prepares for these by keeping cash reserves and staying flexible.

How Much Money Do You Need to Start?

You don’t need millions to start investing in real estate. But you do need a clear idea of what you can afford.

For most property purchases, you’ll need a down payment—usually 15% to 25% of the price. For example, a $200,000 home may require $30,000 to $50,000 upfront. But there are ways to buy rental property with no money down if you meet certain conditions.

You’ll also need money for closing costs. These can include fees for the loan, inspections, insurance, and legal paperwork. Expect an extra 2% to 5% of the purchase price.

Don’t forget about repairs or updates. Many homes need some work before they’re ready to rent or resell. Set aside extra funds for this.

If you want to start with less money, you can invest in REITs or real estate crowdfunding. Some platforms let you invest as little as $100. These options don’t give you full control, but they are a good way to start learning and earning.

Is Real Estate a Safe Investment?

Real estate is generally seen as a stable, long-term investment, but it still carries risks. Property values can go up or down based on local market conditions, interest rates, or the economy.

The main risk is buying at the wrong time or in a bad location. A property that seems like a good deal can lose value if the neighborhood declines or demand drops.

Another risk is unexpected costs. Repairs, vacancies, or legal issues with tenants can lower your income. Always plan for surprises by keeping emergency funds.

However, real estate also has strong safety features. It is a physical asset, unlike stocks. People always need housing, so there is usually some demand. If you choose a good location and manage it well, the value often rises over time.

You can also reduce risk by diversifying. Owning different types of property or combining real estate with other investments spreads out potential losses.

Tools and Resources to Help You

You don’t have to figure it all out on your own. Many tools and resources can help you start and grow your real estate investment journey.

Use real estate calculators to check if a property makes financial sense. These tools help you estimate costs, rent income, cash flow, and return on investment.

Read beginner-friendly books about real estate investing. Look for titles with simple language and real examples. Blogs and YouTube channels can also offer free, easy-to-understand tips.

Listen to podcasts hosted by experienced investors. They often share mistakes, lessons, and practical advice.

Join online real estate investment groups, forums and communities. These groups let you ask questions, share ideas, and learn from others with more experience.

Explore platforms for REITs and crowdfunding. Sites like Fundrise or RealtyMogul allow you to invest small amounts and track your progress.

Good information can save you time and money. Learn before you act.

Partnering with a Real Estate Agency

Real estate investing can be a smart way to grow your money, even if you’re just starting out. You don’t need to be wealthy or experienced to begin. With clear goals, the right strategy, and basic knowledge, you can take your first step with confidence. Start small, avoid common mistakes, and keep learning as you go. Whether you invest in rental properties, REITs, or crowdfunding platforms, real estate rewards consistency and long-term thinking.

If you’re ready to purchase your first investment property—or want to expand your real estate portfolio—First Star Realty is here to help. Our experienced agents are committed to helping you find the right investment property, primary home, or secondary residence in Northwest Arkansas. We provide personalized, five-star service and guide you through the entire buying or selling process so you feel supported at every step.

At First Star Realty, client satisfaction comes first. Our team of trusted real estate professionals is ready to help you find the right property or sell your current one with confidence. Call us at 479-267-1600 or fill out our contact form to get started today.